Transbank is the most important payment media company in Chile, being a pioneering company that has set the standard for the industry. It aims to connect people and businesses through flexible and innovative solutions, contributing to the development and evolution of the country and society.

As a leader, it has forged a trajectory in innovation and implementation of cutting-edge products and services, with both in-person and non-in-person payment solutions that adapt to the needs of businesses and individuals, standing out for high standards of security and availability.

In this way, Transbank has around 700 employees to offer innovative solutions that adapt to the needs of businesses and individuals to over 200,000 entrepreneurs, whether small, medium, or large, generating an average of 8 million daily transactions, and significant impact on their respective sales channels.

The Challenge

The main challenge was to generate engagement with outsourcers and achieve timely transmission of information, standardization of knowledge, and cultural values that would be reflected in excellence in customer service and preference towards Transbank. For the client, it was important to create a common space for their external collaborators (1,000 users) to make them feel like they are part of the organisation and understand the importance of their role in Transbank’s value chain.

Client needs included: centralizing service protocols, reducing manual information transfer, standardizing training plans, connecting external staff with Transbank, and establishing a formal, single communication channel visible across different devices (smartphones, tablets, laptops, etc.). Additionally, the channel should reduce logistical, human, and travel costs associated with acquiring knowledge.

Similarly, obtaining data on outsourcer performance was essential to improve customer experience, increase NPS and process/channel satisfaction, boost efficiency, reduce site visits/calls, increase revenue, and attract customers across different markets.

The Solution

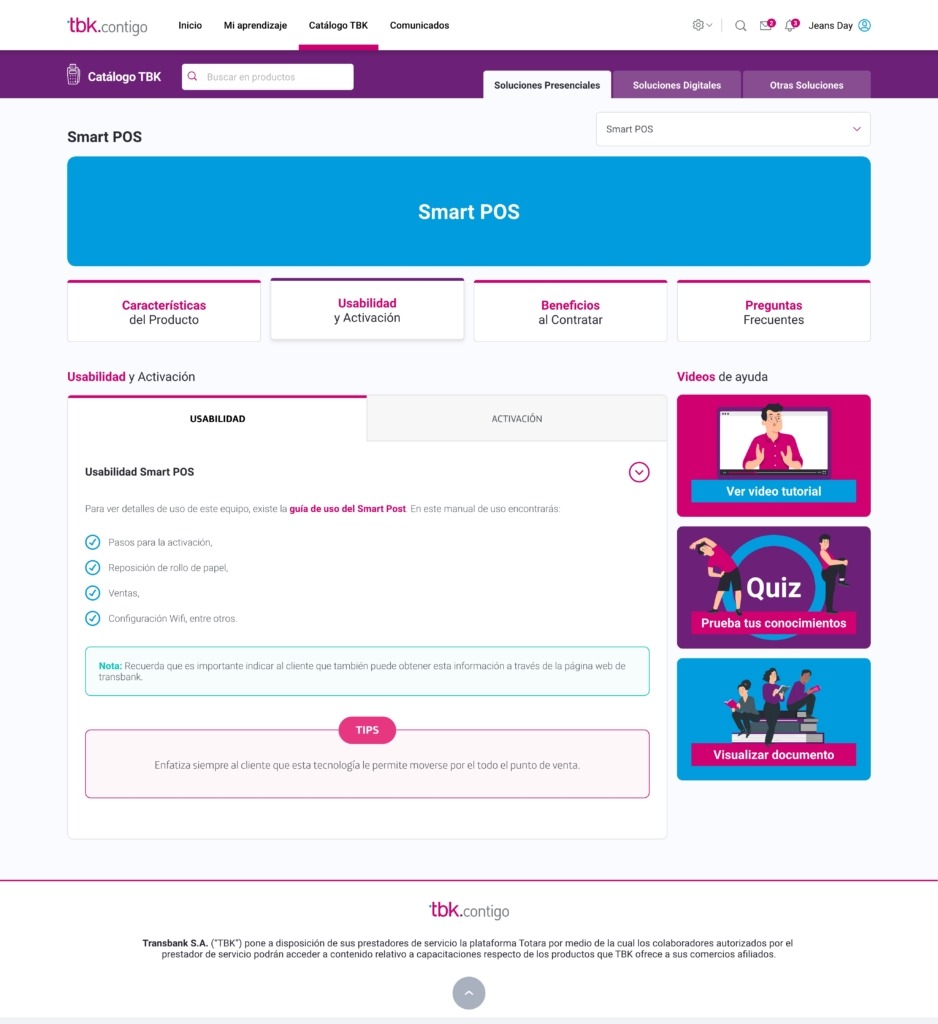

The client’s need led to the development and implementation of the Totara platform, integrating learning content, information modules and communication channels to standardize knowledge among the different outsourcers. As a result, a distinctive Transbank service and attention stamp would be achieved, perceived as close, consistent, and solution-oriented for customers.

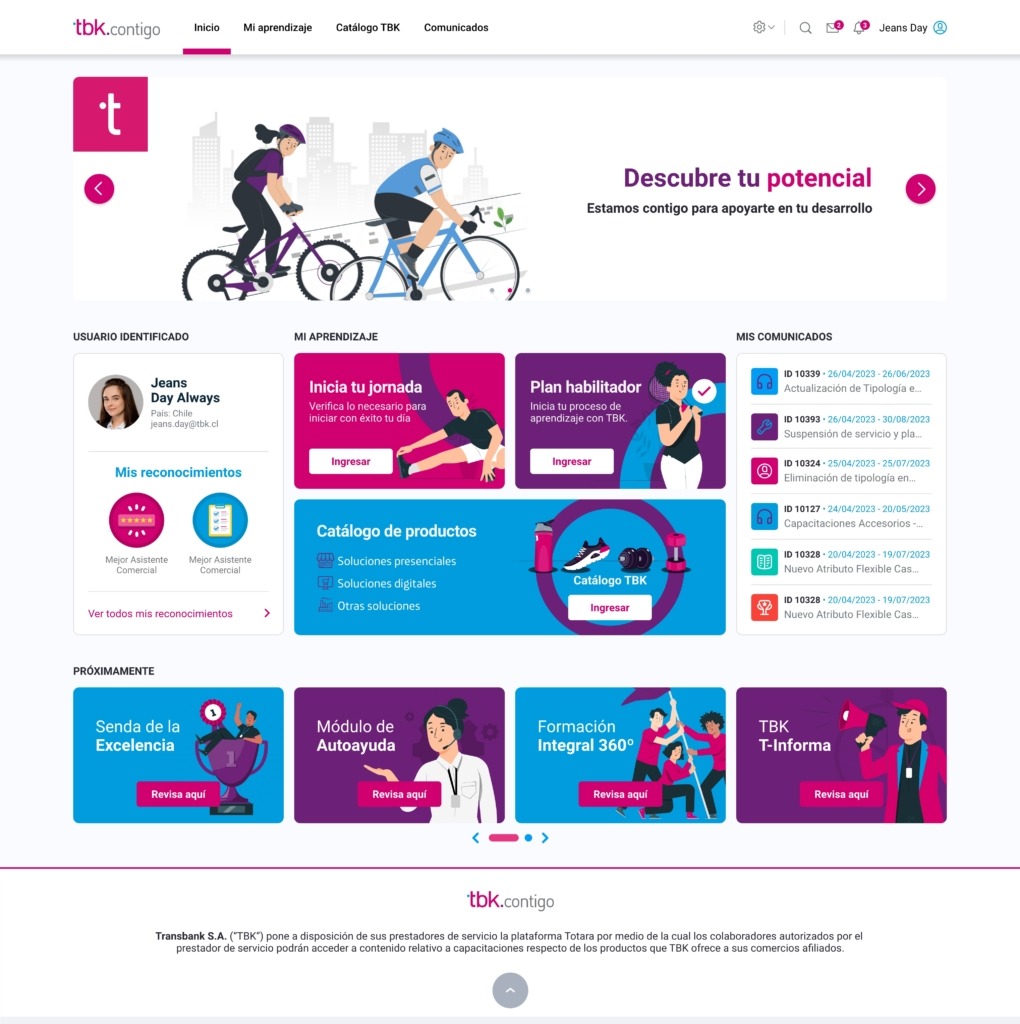

To achieve the set objectives, especially user engagement with Transbank, workshops such as requirement gathering, inception, discovery, focus group, needs prioritization, and consolidation were conducted. This resulted in the graphical customization of the platform and the definition of 3 MVP’s (Minimum Viable Products) in the first phase: Communication, Training, and Data. The Totara Experience Platform fulfilled all these requirements with its Learn, Engage and Perform functionalities.

The starting point was the graphical customization of the platform to align it with the client’s brand and make it user-friendly and approachable for the users.

Working with the client requires receiving feedback, relevant suggestions and creating forums, as well as having daily data and information in pop-ups. There are functionalities that the Engage module facilitates in its creation and management, enhancing collaboration and community building.

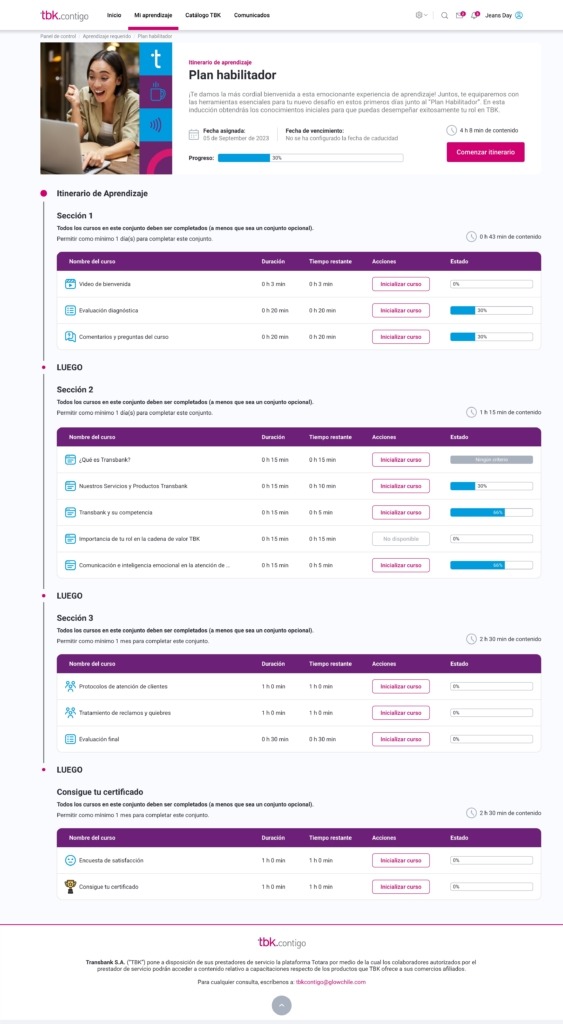

With the Learn module, we were able to create a learning itinerary, including certifications, performance evaluations, and a level of flexibility that anticipated the various requirements and challenges the client might have, such as different audiences, diverse learning plans, and competencies development , among others.

Regarding the Perform module, it allowed us to project the improvement of our teams’ skills with the aim of increasing satisfaction among our end customers. This is achieved by enabling us to track progress, measure gaps, adjust KPI’s and evaluate results for the continuous improvement process.

The Result

By leveraging the tools provided by Totara, we were able to develop a robust platform that has enabled the creation of a distinctive seal of Transbank service and attention stamp for its employees and outsourced companies. As a result, the following achievements can be highlighted:

- Centralize and Streamline Document Base: Implemented a centralized document repository within Transbank containing service protocols, procedures, manuals, and other relevant documents to streamline access and ensure consistency.

- Reduce Manual Information Transfer: Utilized digital platforms and automated systems to minimize manual information transfer between Transbank and external companies, enhancing efficiency and accuracy.

- Standardize Training Plans: Established standardized training plans for external personnel, ensuring uniformity and effectiveness in skill development across the workforce.

- Promote Connection with External Personnel: Implemented initiatives to foster closeness and connection between external personnel and Transbank, such as engagement activities, communication channels, and collaborative projects.

- Establish Communication Channel: Set up a dedicated communication channel to promptly and uniformly inform personnel in contact with clients about relevant topics, including ongoing campaigns, product launches, service incidents, and new protocols/procedures.

- Implement Onboarding Plan: Developed an onboarding plan with metrics, results, certification, and profiling for three target audiences related to sales channels and technical roles, with a projected user base of around 1000 individuals. This plan aimed to ensure a smooth integration process and effective performance from the start.

- Standardized Knowledge: The platform successfully homogenized participants’ knowledge, leading to improved customer service.

- Daily Metrics and Reporting: Daily metrics were obtained, and appropriate reporting was provided for training processes, enhancing monitoring and evaluation.

- Timely Implementation: The project was successfully implemented on the platform within a three-month timeframe, achieving a 94% completion rate for the Onboarding Plan during the pilot phase.

- User Feedback: Diverse feedback was provided through the community tool, with 40% of participants in the pilot plan contributing feedback.

- Impact on KPIs: It’s anticipated that the Totara platform will contribute to improving and increasing various company KPIs, such as relational NPS, increased number of transacting clients, satisfaction with processes and channels, as well as platform-related metrics like user adherence to training, regular usage, and the number of qualified external personnel upon completion of the onboarding process.

“Glow has been a fundamental ally for Transbank. With our new training and communication platform, we have centralized and standardized the training of our external customer service executives in an easy and intuitive way. Glow has been key in adapting Totara to our needs.”

Customer Experience Deputy Manager at Transbank